The intersection of the two lines indicates the break-even point. The total cost line is the sum total of fixed cost ($3,000) and variable cost of $15 per unit, plotted for various quantities of units to be sold. The total revenue line is plotted, running from $0 at zero sales volume to $150,000 at a sales volume of 6,000 units at $25 per unit. The units sold are plotted on the horizontal axis, while total revenue is shown on the vertical axis. In plotting the graph, it is assumed that the selling price remains at $25, the variable cost remains at $15 per unit, and the fixed cost remains at $30,000 over the range of units sold. To give an example, consider how the data in the table below have been used to create the break-even chart. Graphical analysis also enables managers to identify areas of profit or loss that would occur for a broad range of sales activities. Doing so comes with the advantage of showing CVP relationships over a range of sales. First, we drew two axes: a vertical one displaying costs and a horizontal one displaying quantity.Cost-volume-profit (CVP) relationships, or break-even relationships, can be visualized using graphs.

These are the steps we followed drawing the break-even chart for the company X: 7 - Labelled break-even chart exampleįigure 7 illustrates a labelled break-even chart for company X where: How many chairs per month does the company have to produce and sell to reach the break-even level of output?įig. The rental cost of a factory is £12,000 a month and bills are £3,000 a month. Let's take a look at an example of a break-even analysis chart. The break-even point is the quantity (number of units) at a level where total costs and revenue intersect. The break-even point is the intersection point of the total costs and revenues lines.įigure 6 illustrates the break-even point (🔴). Now we need to mark the break-even point. Depending on its value, the line can have a more vertical or horizontal inclination. Since revenue is directly related to quantity, the line will start at the intersection point of the horizontal and vertical axes and increase gradually.įigure 5 illustrates a line indicating revenue (R). Now we need to draw a line indicating revenue. Since variable costs rise and fall in direct proportion to the number of units, the line will start at the intersection point of the axes and gradually increase. Now we need to draw a line indicating variable costs. Step 3: Draw a line indicating variable costs Depending on its value, the line can be lower or higher on the chart. Since fixed costs remain the same (in the short term), regardless of the number of units produced, this line will be horizontal and parallel to the axis that displays quantity.įigure 2 illustrates a horizontal line indicating fixed costs (FC) which are constant. Now we need to draw a line indicating fixed costs. Step 2: Draw a line indicating fixed costs Horizontal axis - this one will display quantity.įigure 1 illustrates the two axes in the break-even chart (cost and quantity).

Vertical axis - this one will display costs.

#Managerial accounting break even point formula how to

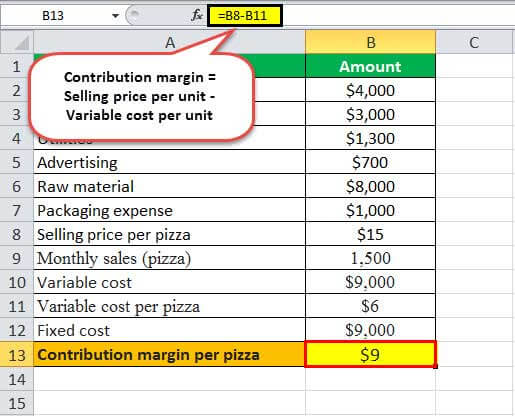

Table 1 - Types of Costs Definitions and Examples How to draw a break-even analysis chart?ĭrawing a break-even chart consists of six steps: Rent and rates, raw materials used in production and direct labour added together

Raw materials used in production, direct labourįixed costs and variable costs added together TermĬosts that remain the same regardless of the number of units producedĬosts that rise and fall in direct proportion to the number of units produced Each of them is represented as a line that indicates its value depending on the level of output. The break-even chart includes four variables: fixed costs, variable costs, total costs, and revenue. It is the number of units a firm has to produce and sell to recover its total costs. Lifestyle and Technological Environmentīreak-even is the level of output at which revenues from sales equal total costs.Business Considerations from Globalisation.Risks and Rewards of Running a Business.Evaluating Business Success Based on Objectives.Information and Communication Technology in Business.Effects of Interest Rates on Businesses.Improving Employer - Employee Relations.

0 kommentar(er)

0 kommentar(er)